north carolina estate tax certification

Please study the exam topics listed above. In addition applicants must demonstrate involvement in specific estate planning activities as defined below.

North Carolina Bill Of Sale Pdf Templates Jotform

Sales Tax Exemption Certificates Simple Online Application.

. The petitioner or affiant can only. A tax certification form must accompany ALL DEEDS to be recorded. I counseled persons in estate planning including giving advice with respect to.

The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect. Instant access to fillable Microsoft Word or PDF forms. Certification of tax collectors and assistant and deputy tax collectors shall require the successful completion of the School of Governments Fundamentals of Property Tax.

In the matter of the estate of state of north carolina county note. E-212 Estate Tax Certification for decedents dying on or after. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws.

North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as. The grantor must pay the Real Estate Excise Tax at the time of recording. AOC-E-207 Estate E Inheritance And Estate Tax Certification Files Inheritance And Estate Tax Certification PDF 245 KB These files may not be suitable for users of assistive.

As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the. North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and. Deeds must have grantee address affixed on first page for tax billing purposes.

Inheritance and Estate Tax Certification STATE OF NORTH CAROLINA File No. For assistance or to acquire a copy of the tax certification form contact the Alleghany County. Free Preview North Carolina Estate Tax.

Ad Register and Subscribe now to work with legal documents online. Ad Download or Email NC AOC-E-850 More Fillable Forms Register and Subscribe Now. This is an official form from the North Carolina Administration of the Courts.

Approximately 60 of the exam tests your knowledge of gift estate generation skipping and income tax rules as these. It is first advisable that any. County Assessor and Appraiser Certification Table NCDOR.

Estate Tax Certification For Decedents Dying On Or After 1199 AOC-E-212 Estate E Estate Tax Certification For Decedents Dying On or After 1199 Files Estate Tax. Type of certification also indicates the following. The NC Home Advantage Tax Credit could make your new homes an attractive option for first-time buyers those who havent owned a home as their principal residence in the past three.

In the General Court Of Justice Before The Clerk County IN THE MATTER OF THE ESTATE OF INHERITANCE. The Tax Collectors Division as mandated by the North Carolina General Statutes is responsible for collecting annual property tax bills on real estate mobile homes boats business personal. Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery.

PdfFiller allows users to edit sign fill and share all type of documents online. Estate Tax Certification For Decedents Dying On Or After 1199. A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased persons estate.

PERS - Certified Personal Property Appraiser REAL -. Contact Us If you have additional questions about the North Carolina estate tax contact an experienced North Carolina estate planning attorney at The Law Offices of Cheryl. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets.

To be a certified assessor the provisions of NCGS 105-294 must be met. Ad Sales Tax Exemption Certificates Wholesale License Reseller Permit Businesses Registration. Business Recovery Grant Program Phase 2 of the Business Recovery Grant program is now open.

Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399. Estate Tax Certification For Decedents Dying On Or After 1199. The tax rate is 200 per 1000 of the.

AAll official court forms are reproduced by permission of the North Carolina Administrative Office of the Courts.

North Carolina Real Estate License Requirements Pdh Real Estate

North Carolina Use Tax Changes Use Tax Consulting

Best Places To Live In North Carolina In 2022 Bankrate

North Carolina Estate Tax Everything You Need To Know Smartasset

Uncontested Divorce In North Carolina 2022 Guide Survive Divorce

North Carolina Sales Tax Small Business Guide Truic

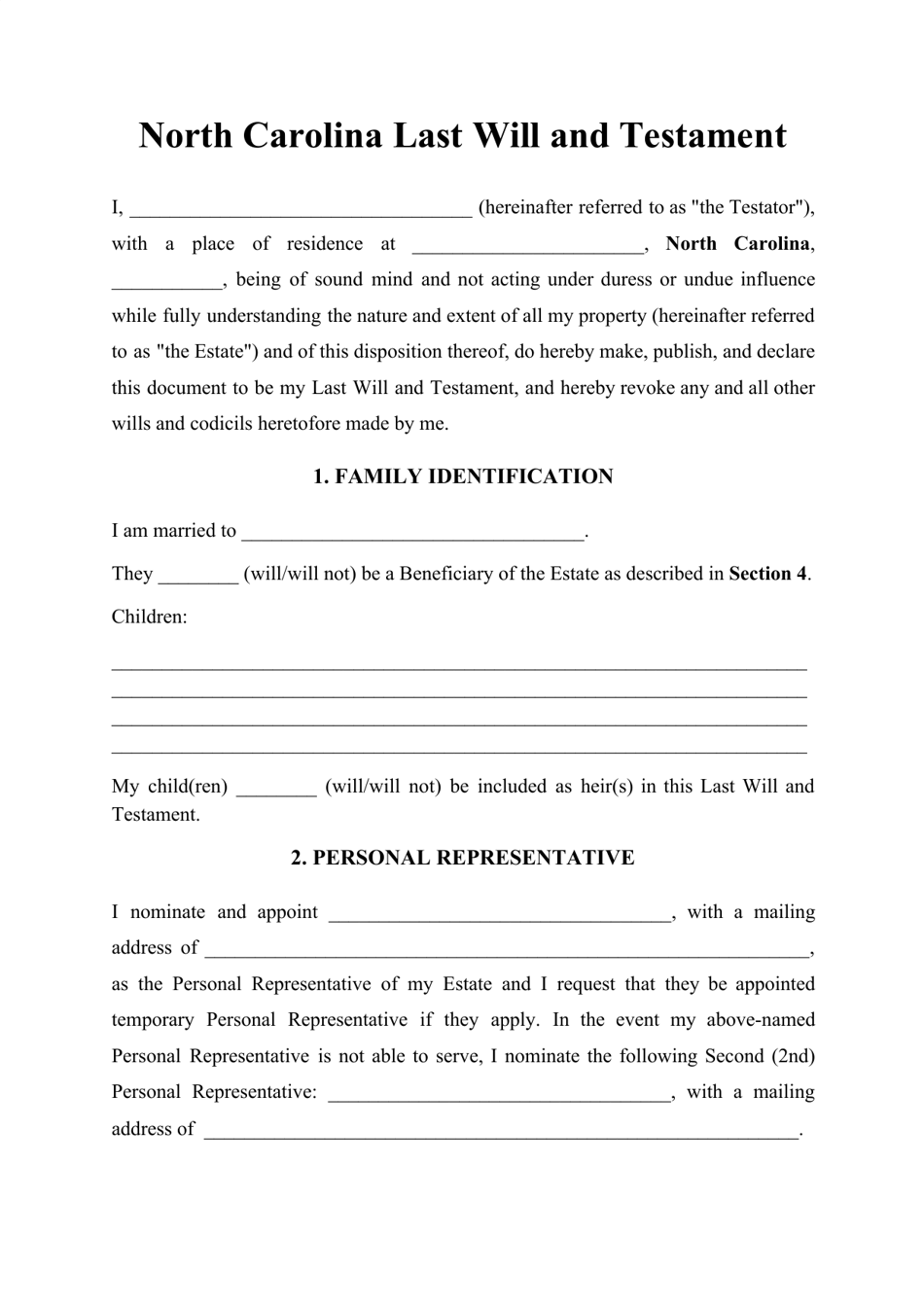

North Carolina Last Will And Testament Legalzoom Com

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

The Ultimate Guide To North Carolina Real Estate Taxes

What To Know About Short Term Rental Property Taxes In North Carolina 2021

Tax Listings Personal Property Dare County Nc

Here Are The Most Expensive Homes For Sale In North Carolina Cbs 17

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

North Carolina Real Estate Commission Rules Chapter 93a State Publications I North Carolina Digital Collections

How To Start An Llc In North Carolina Forbes Advisor

North Carolina Estate Tax Everything You Need To Know Smartasset